Configure Use Tax

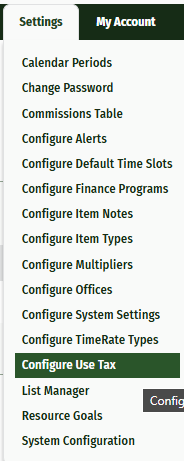

To begin, navigate to the ‘Settings’ dropdown menu and click ‘Configure Use Tax’

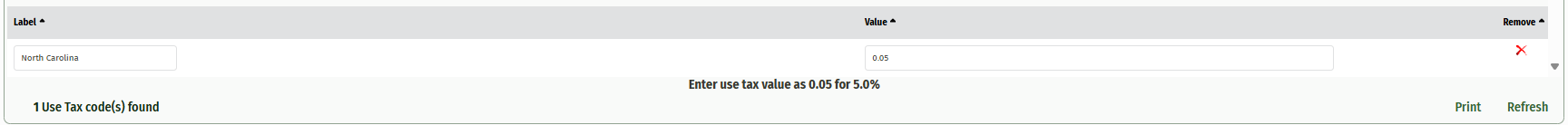

Once on the Use Tax page, click the ‘Add Use Tax’ button at the top left of the screen.

On this page you can add a label for your use tax, an example of this could be the abbreviation of the state. Under the value, enter in the use tax rate. Percentages should be entered as a decimal, i.e. 7% should be entered as .07.

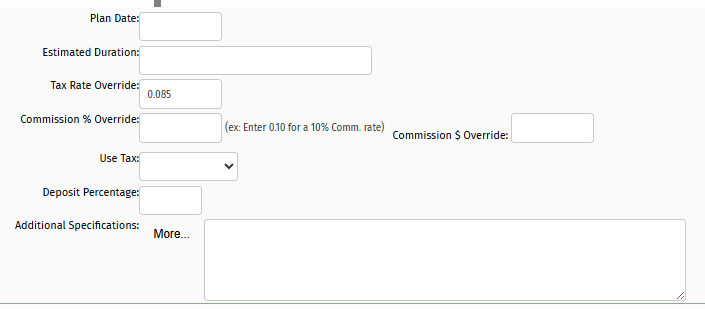

The Use Tax can be assigned to a job on the bid worksheet at the bottom of the screen.

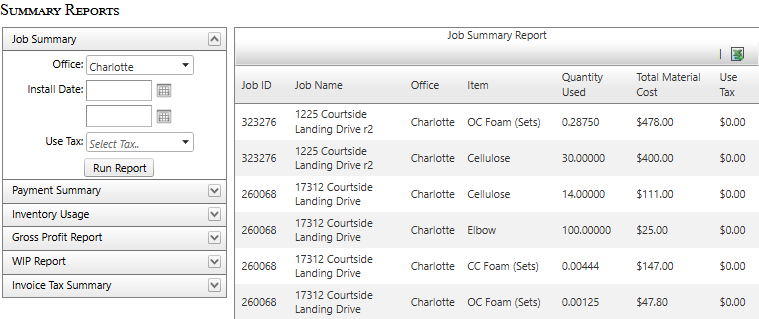

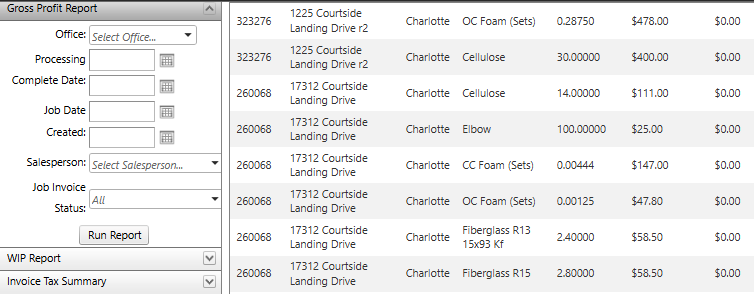

The amount of use tax displays in two reports for you to view. The first is the Job Summary Report and the second is the Gross Profit Report. Both of these are found under the reports dropdown in Summary Reports.

Running either of these reports will give you the use tax (tax on the material cost only).